RECENT POSTS

- ZATCA Compliant e-Invoicing in Saudi Arabia

- Key Features to Look for in a Supermarket POS Software

- How to Choose the Right POS System for Your Business

- What is a POS System? A Complete Guide for Beginners

CATEGORIES

Home | Insights | ZATCA Compliant e-Invoicing in Saudi Arabia

ZATCA Compliant e-Invoicing in Saudi Arabia

To streamline and digitize the invoicing process, the e-Invoicing concept has emerged: the electronic generation, transmission, and processing of invoices. This paper-less invoicing concept has revolutionised the traditional tax system and is beneficial for both businesses (trading partners) and the government. Here, this article is all about the e-Invoicing initiative in Saudi Arabia, which is implemented by ZATCA.

What is ZATCA?

ZATCA is the acronym for Zakat, Tax, and Customs Authority (formally known as General Authority of Zakat and Tax (GAZT)) and this is the Saudi Arabian government agency under the Ministry of Finance, founded on 14 June 1951 for handling the collection of zakat, taxes, and customs duties. As part of improving the efficiency of Saudi Arabia’s taxation and customs processes, electronic invoicing (e-Invoicing) has been made mandatory for resident taxpayers subject to VAT.

What is e-Invoicing in Saudi Arabia?

To streamline business operations, ZATCA has developed the FATOORA portal to generate e-Invoices. With this portal, taxpayers can onboard their EGS (E-invoicing Generation Solution) units by generating a cryptographic stamp identifier (CSID) and renew existing CSIDs. E-invoicing statistics and API documentations can also be found in the FATOORA Portal.

According to the country’s government regulations, all VAT-registered resident business owners in Saudi Arabia providing B2B, B2G and B2C transactions within and outside the country should adhere to the e-Invoicing regulations. Regardless of the tax rate, ZATCA e-Invoicing is applicable for all taxable products and services subject to VAT. These regulations also apply to third parties issuing invoices on behalf of taxable individuals.

Phases of E-Invoicing Regulations

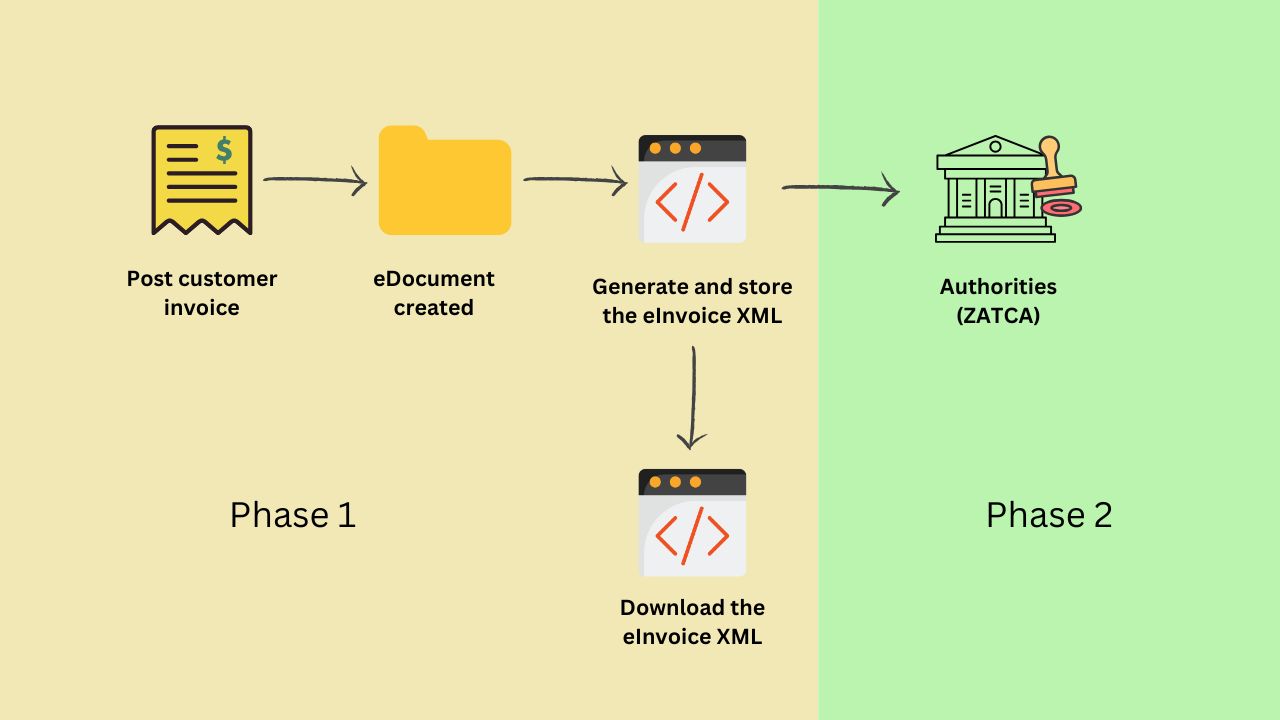

When considering the history of e-Invoicing Regulations in KSA, the initial draft was issued by ZATCA in March 2021 and was finally published on 28th May 2021 after taking the feedback from the public and stakeholders. Later, the implementation of e-Invoicing solution happened in two different phases: Phase 1 and Phase 2.

The phase 1, which is the generation phase of e-invoicing, was implemented on December 4, 2021. This was the initial step from ZATCA and here the taxpayers were asked to generate e-Invoices, credit notes, and debit notes with the help of a ZATCA-compliant electronic billing system by including specific details such as VAT registration number, taxpayer’s name, recipient’s name, and more. In the phase 1 rollout, standardized QR codes with tax information were added in the invoices for B2C transactions (optional for B2B transactions).

The integration phase (Phase 2) rollout began from January 1, 2023, and the implementation was dependent on taxpayer groups based on turnover. In this phase, the electronic billing system of businesses will be integrated with ZATCA’s e-invoicing systems (FATOORAH) and each electronically generated invoice will be validated before issuance. The key requirements in the phase 2 implementation are:

- The E-Invoicing solution for businesses needs to be connected with the FATOORAH portal with Application Programming Interface (API).

- Each of the generated invoices must include a cryptographic stamp, digital signature, Universally Unique Identifier (UUID), and auto-generated sequential number.

- E-Invoices must be issued and stored in a ZATCA-designated XML format.

- Mandatory for B2B, B2G and B2C transactions.

According to ZATCA notifications, the phase 2 implementation is expected to get completed by November 2025, as this was happening in different waves, depending on the VAT turnover of businesses.

In general, the phase 1 rollout aimed to familiarize businesses with the e-invoicing concept and the phase 2 integration allowed businesses to exchange real-time data with ZATCA.

Benefits of ZATCA e-Invoicing

ZATCA introduced e-Invoicing in Saudi Arabia to minimize administrative burden on businesses and to improve compliance with tax regulations. E-Invoicing concept will also improve the efficiency by offering faster and more accurate tax assessments. Other key benefits are:

- Increases the business cash flow by providing quicker tax credits to buyers.

- Will simplify cross-border trade and enhance competitiveness in the global market.

- Prevents tax evasion, fraud, and underreporting of revenues.

- Accurate tax calculation with real-time reporting and tracking

- Reduced risk of loss or damage compared with traditional paper invoices.

Along with the above benefits, businesses also face certain challenges in the initial phase such as the cost for software and infrastructure upgrades, and additional training requirements for employees.

Ready to Transform Your Business?

Saleculator helps you simplify your work, grow your sales, and hit your goals without the hassle. See how it works. Book a demo today!